SSE is saving residents money by offering:

Neighborhood pricing discounts

Minimal trip charges

Quick turnaround times

Minimal trip charges

Quick turnaround times

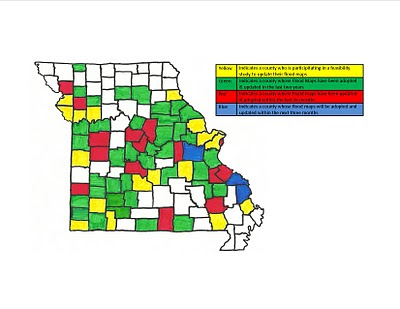

LAKE OZARK MO- More and more residents in the Lake of the Ozarks region and all over Missouri are being required to prove that their home is not in a flood plain. Many have lived in their homes for several years with no flooding problem but because the Federal Emergency Management Agency, or FEMA updated the lake area flood maps last year; residents are being required by insurers, lenders and FEMA to prove that they are not in the flood plain.

|

| Here is a sample FIRM map |

FEMA occasionally changes the floodplain boundaries because of things such as population growth or decline, levee changes, and infrastructure improvements. Also better technology allowing for better mapping can change a FEMA map. These changes can move a property owner previously out of the floodplain smack into the floodplain. This is the case for many residents of Camden County, Missouri. Planning Administrator, Chris Hall said, “Some portions of the lake have had their BFE (Base Flood Elevation) level increased and those areas are adversely affected by these changes.”

This has caused the most trouble for lakefront homeowners. SSE owner Stan Schultz added, “When an insurance provider or a bank views the new maps, they are almost guaranteed to deem lakefront property as part of the floodplain even though the property has never even been close to flooding.”

Here is an example of how it might work on let’s say Mr. Smiths lakefront home. Mr. Smith was dumbstruck last year when the bank that holds his mortgage sent a letter alerting him that he had to purchase flood insurance for his home on the lake. In 30-plus years, the lake has never has gotten close to the house, and insurance was never required before. But the Federal Emergency Management Agency, or FEMA, updated its flood maps last year, and Mr. Smith’s home was declared at risk of flooding. Not only that, his house went from requiring no insurance to being in the highest possible flood-risk category.

According to FEMA, the national average for the cost of flood insurance is $600 a year, but Mr. Smith pays $1,100 annually. During the 25-year life of his mortgage, he will have paid close to $30,000 to protect his high-and-dry home from floodwater that would have to be delivered to his house in buckets.

Mr. Smith said, “If there had been a flood issue, I’d have walked away from this place and not bought it. I wanted nothing to do with a flood. Now I’ve gone from being in a ‘No problem area’ to being in the worst possible classification.” His insurance agent Mr. Jones, said he tried to help Mr. Smith do battle with the government, but the pair got nowhere. “Not only was his house put in a floodplain after all these years, but they put him in the highest category,” Agent Jones said. “Mr. Smith is in the same flood zone as someone who lives directly on the river — Zone A. “He’s probably paying four times more than he would if FEMA put him in Zone B. It seems crazy.”

|

| Missouri map showing affected counties |

But the folks at FEMA say that is just not true. Laurie Smith-Kuypers, Natural Hazards Program Specialist in FEMA’s Chicago office, said “It’s not that big of a deal to ask the agency for reconsideration. All the homeowner has to do is hire a surveyor to produce an elevation certificate, proving his house is not in the floodplain.”

Hiring a surveyor to come out and check the flood elevation can be expensive, plus there is no guarantee your home will be out of the floodplain. Schultz and Summers owner Stan Schultz said “SSE developed a special flood certification process to help residents deal with the FEMA map changes.” He added, “We tried to keep the costs as low as possible. For a few hundred dollars we will come out and survey the property as well as turn all the paperwork into FEMA so the homeowner will get a Letter of Map Amendment (LOMA) that they can provide their lender or insurer.” Schultz continued, “Another benefit we offer is the minimal trip charge. Many times after our surveyors shoot the elevation they can determine if the home is not going to qualify for a LOMA. We offer all our clients the option of stopping work and paying only a minimal trip charge.”

|

| Add caption |

After visiting with SSE we contacted a few of their customers to see exactly how the service worked. Philip Houghton from Gravois Mills, MO found out he was going to be required to purchase flood insurance a week before closing on his third floor condominium. The quote for his insurance was estimated to be $3500. He was told to purchase the flood insurance or forfeit the sale.

Mr. Houghton called SSE and asked how much an elevation certificate would cost and could the whole process be completed before his closing. He said, “I didn’t know if they could do it in time but amazingly they came out, did the survey and had the LOMA in less than 24 hours!” In this case a homeowner was able to prove that the property was not in the flood zone allowing the lender to close the loan without forcing Mr. Houghton to purchase expensive flood insurance. Houghton added, “The service I received from SSE was fast, professional, and fairly priced. They not only saved me money they kept my real estate transaction from falling apart.”

Another interesting story showing the difficulties the new FEMA maps have caused concerns. Randall Carr and Susan Gepford from Stover, MO were tired of paying for flood insurance and hired Schultz and Summers Engineering to do a survey to see about obtaining a LOMA from FEMA and dropping their expensive flood insurance. Susan said, “The surveyor came right out but unfortunately he informed us that our home was not going to qualify for a LOMA. They asked us if we wanted to stop the process and pay the $100 trip charge or if we wanted to have them finish it up and see if we would come out in a cheaper flood zone.” She continued, “We told them to go ahead and finish it and even though we were still in the flood plain, our new elevation certificate lowered our flood insurance by $897!!”

|

| Stan looking over a flood elevation survey |

No comments:

Post a Comment

Thanks you for your thoughts and comments. It is our hope that these posts will generate a helpful and interesting discussion.